Finance

WasteCo

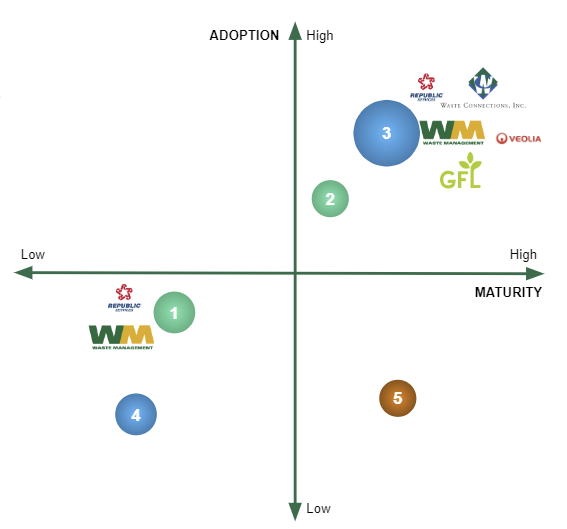

We partnered with a multibillion-dollar company to boost financial performance. By uncovering hidden revenue in existing contracts, aligning financial and operational metrics, and optimizing cash flow, we increased profitability and liquidity. These strategic moves positioned the company for sustainable growth and market adaptability

The Challenge

Like households, businesses gain financial habits. Sometimes, that is keeping too much cash in our checking accounts versus seeking higher-yielding savings accounts. Other times, we pay bills when we receive them, not when they’re due, thus helping our creditors’ working capital accounts.

These factors are great starting points for our clients’ strategic planning processes and metrics.

The Solution

The Berkeley Innovation Group partners with clients to co-create solutions to address these challenges. Here are some examples from a recent engagement.

1. Marginal Revenue Discovery

A dedicated team was formed to identify and monetize "extras" - allowable upcharges defined within existing agreements. The goal was to achieve an industry norm of 3% of revenues from these extras. Simultaneously, the team initiated design sprints to explore and prototype add-on services for existing customers.

2. Financial Metrics Integration

A cross-functional team unified finance, operations, and IT to create interconnected metrics such as "profit per hour per operation." This approach required:

- IT systems to collect operation-level data

- Operations to optimize labor and equipment allocations

- Finance to monitor profitability

The team also implemented a profit center designation for each step in the value chain, enabling peer-to-peer performance comparisons and informed decision-making based on local market conditions.

3. Cash Conversion Cycle Optimization

Efforts were made to shorten the Cash Conversion Cycle, improving the company's liquidity and ability to invest in critical areas such as equipment modernization and operational improvements without incurring unnecessary finance charges in a rising interest rate environment.

The Solution

The implementation of these initiatives yielded significant benefits:

- Increased marginal revenue through better enforcement of "extras" and new add-on services

- Improved decision-making capabilities through integrated financial and operational metrics

- Enhanced liquidity and capital efficiency due to optimized Cash Conversion Cycle